Legal News

Latest legal news and

events in our backyard.

The Law Lowdown – SPRING 2025

Catch up on all the news and information in this edition of The Law Lowdown Inside this issue: Download your copy here

Trust Property Sales: Simplified Rules but Ongoing Responsibilities

Recent changes to New Zealand’s Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT) have eased compliance requirements for family trusts, particularly when selling property. The reforms, in force from June 2025, respond to long-standing criticism that the old rules placed too much burden on low-risk transactions. What Has Changed Previously, whenever a trust was involved in a property sale, lawyers and other reporting entities were required to complete full due diligence. This meant identifying not only trustees but also

Why Retirement Villages Require Enduring Powers of Attorney

When moving into a retirement village in New Zealand, new residents are usually asked to have an Enduring Power of Attorney (EPA) in place. This may feel like another bit of administration to add to the paperwork, but it is an important safeguard for both residents and their families. Why an EPA is Required An EPA allows you to appoint someone you trust to make decisions on your behalf if you lose the ability to do so yourself. There are

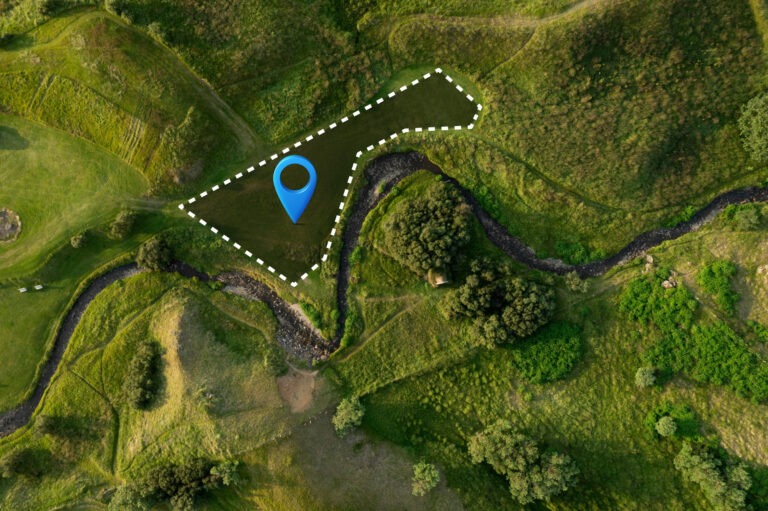

Understanding Easements

When you buy or own property in New Zealand, you may come across the term easement. Easements are a common legal feature of land ownership, and while they can sound technical, they play an important role in allowing landowners to use their property effectively. What is an Easement? An easement is a legal right to use someone else’s land for a specific purpose. It does not give ownership, but it allows the owner of one property (the “dominant tenement” (land))

The Law Lowdown – WINTER 2025

Catch up on all the news and information in this edition of The Law Lowdown Inside this issue: Download your copy here

CHARITY TAX REFORMS PAUSED – FOR NOW …

The Government’s proposed changes to the tax treatment of charities have sparked significant concern across the charitable sector. While the reforms have now been put on hold, they have not been withdrawn—and are expected to resurface in revised form. BACKGROUND TO THE PROPOSED CHANGES The proposals sought to tighten rules around business income earned by charitable entities, particularly where that income is retained or used overseas. Under the proposed changes, income would only remain tax-exempt if it was applied for